how to pay meal tax in mass

The maximum tax that can be enacted on meals in. Web Nine communities this spring adopted the local-option meals tax bringing the total to 172 or roughly half the communities in the state.

Mass Ct Tax Structures Come Under Spotlight Hartford Business Journal

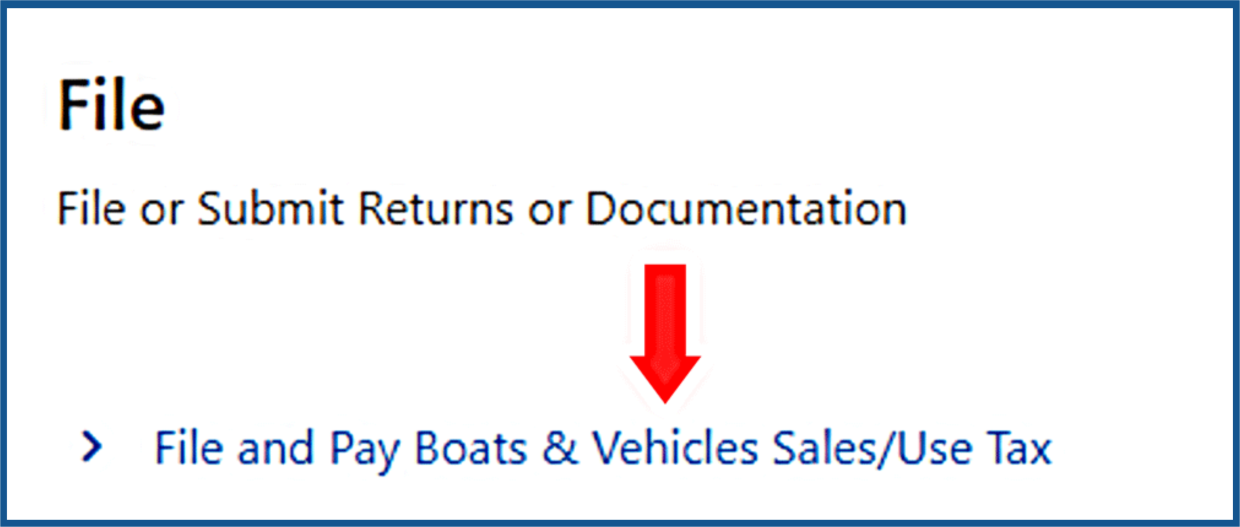

Web Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

. 508-830-4062 Town Hall Hours. Springfield was one of 49 Massachusetts cities and towns to adopt the local-option. Paying the full amount of tax.

Web Massachusetts meals tax vendors are responsible for. Sales of meals to Harvard students are tax-exempt if. Small businesses in Massachusetts can.

Web 1 hour agoDue to inflation and the shortage of turkeys the price of these meals has more than doubled since last year. Mondays Wednesdays and Thursdays 730 am. Multiply the cost of an item or service by the sales tax in order to find out the total cost.

Massachusetts Department of Revenue DAIGO FUJIWARA. The meals tax rate is 625. The meals tax rate is 625.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Paying the full amount of tax due with the appropriate Massachusetts. Web The tax is 625 of the sales price of the meal.

Web Massachusetts local sales tax on meals. Sales of meals to Harvard faculty and staff are taxable. Web As of October 1 2009 the meals tax in the City of Springfield is 7 percent.

Web Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Web In Massachusetts there is a 625 sales tax on meals. Collecting a 625 sales tax and where applicable a 075 local option meals excise on all taxable sales of meals.

Registering with DOR to collect the sales tax on meals. In the past VCOH has suggested donations of 25 per. Web File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Web Town of Plymouth Massachusetts 26 Court St Plymouth MA 02360 PH. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Web More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Following votes this spring the tax will take. How is meal tax calculated. Our calculator has recently been updated to include both.

Web You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

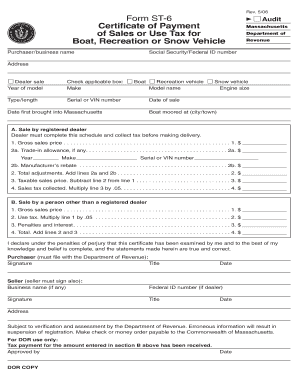

Form St 6 Certificate Of Payment Of Sales Or Use Tax For Mass Gov Fill And Sign Printable Template Online

Massachusetts Sales Tax Guide For Businesses

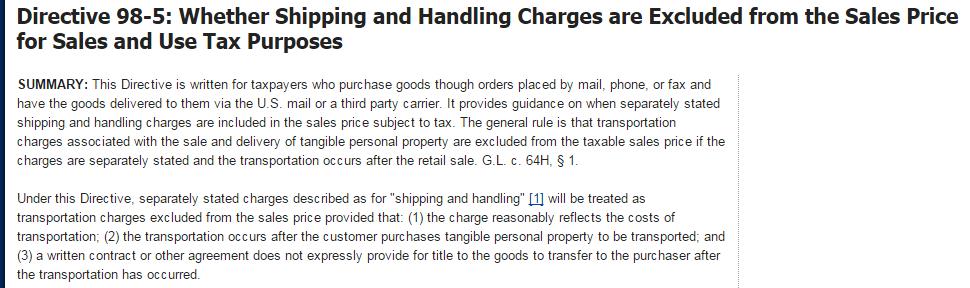

Is Shipping Taxable In Massachusetts Taxjar

Do You Pay Sales Tax On Your Online Holiday Shopping Urban Institute

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Massachusetts Airbnb Vrbo How To Register For The Room Occupancy Tax

Sales Tax Holiday Weekend Set For Aug 13 14

How To File And Pay Sales Tax In Massachusetts Taxvalet

Massachusetts Property Tax H R Block

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

In 2009 Amid Recession Massachusetts Raised Its Sales Tax Rate Could That Fly Now Archives Berkshireeagle Com

Amazon S Sales Tax Free Status Cost States 8 6 Billion

How To Register File Taxes Online In Massachusetts

More Online Retailers Will Have To Pay Mass Sales Tax Boston Business Journal

February Mass Home Sales Hit 17 Year High Wbur News

Massachusetts Used Car Sales Tax Fees

Why Is Gross Sales From Sales Tax Return Wildly Different From Gross Amount On The Sales Tax Liability Report For The Same Period And Same Assessed Tax Amount